- days

- Hours

- Minutes

- Seconds

Date: 2 February 2026

Time: 12:00 - 18:00 GST Followed by a networking reception

Venue: Waldorf Astoria DIFC: Burj Daman, Al Mustaqbal St. Zaa'beel Second, DIFC, Dubai UAE![]()

Overview

The ICMA MENAT Primary Market Forum brings together senior public- and private-sector leaders, issuers, investors, intermediaries, and policymakers to examine the rapidly evolving dynamics of primary markets across the Middle East, North Africa and Türkiye (MENAT). As the region continues to experience strong issuance momentum, expanding market depth and a growing global footprint, this Forum serves as a platform to discuss the opportunities and challenges shaping its next phase of development.

Over the past decade, the MENAT region has distinguished itself as one of the most dynamic emerging market funding hubs globally. Structural reforms, deeper domestic liquidity, diversification of issuer profiles, the rise of sukuk markets, and increasing cross-regional capital flows, particularly between MENAT, Asia and other emerging markets, are transforming the scale, sophistication and international relevance of the region’s primary markets. Against this backdrop, global macroeconomic conditions, shifts in investor appetite and the ongoing evolution of sustainable and Islamic finance continue to redefine the region’s competitive position.

The Forum will bring these themes together through a series of keynotes, panel discussions and case studies designed to provide a comprehensive view of market developments. From the changing funding mix and the growth of local currency markets, to the increasing importance of regulatory alignment, digitalisation and innovation, the agenda highlights both the progress made and the critical enablers required for MENAT’s continued advancement. By convening key stakeholders, ICMA aims to foster dialogue, deepen market understanding and support the region in realising its full potential as a global primary market leader.

Admission: This in-person event is free to attend and open to ICMA members and interested market participants. Register now.

If you have any questions, please contact ICMA events

Lead sponsors

|

|

Supporting sponsors

|

|

|

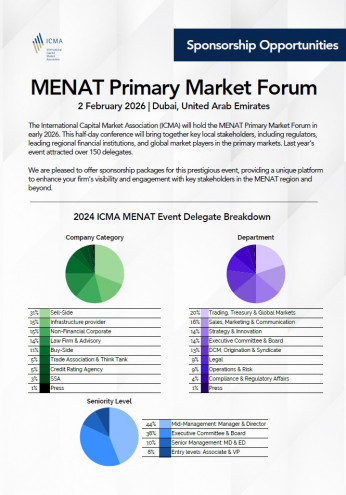

Sponsorship opportunities

Interested in sponsoring this event? Contact us: sponsorship@icmagroup.org. Information about sponsorship opportunities can be downloaded here.

| GST | ||

| 12:00 | Registration and networking lunch | |

| 13:00 | Welcome remarks Mohammed Sharaf, Treasurer, Islamic Development Bank & ICMA MENAT Regional Chair |

|

| 13:05 | Introductory remarks Bryan Pascoe, Chief Executive, ICMA |

|

| 13:10 | Opening keynote address Mukesh Sodani, Financial Advisor , Minister Office, Ministry of Finance , UAE |

|

| 13:25 | Developments in international primary markets This session will provide an overview of global trends and key developments in international primary markets, highlighting evolving market practices, regulatory changes, and emerging themes influencing primary market activity. Ruari Ewing, Senior Director, Market Practice and Regulatory Policy, ICMA |

|

| 13:35 | Panel discussion: The MENAT funding mix, local currency depth and global capital flows This panel will examine the key growth drivers shaping MENAT debt markets through 2025–2027, including GCC sovereign issuance, the leadership of Saudi Arabia and the UAE, and continued momentum in sukuk. The discussion will explore expectations for issuance volumes, the broadening mix of issuers and products across bonds, sukuk, loans, and private credit, and shifting liquidity and investor dynamics—from regional real money and sovereign wealth funds to global asset managers, hedge funds, and private credit. Panelists will also assess the development of the regional investor base and the importance of local-currency market growth through regular issuance and curve building. Moderator: Christopher Wilmot, Group Chief Treasury & Financial Markets Officer, Bank ABC

|

|

| 14:15 | Fireside chat: Regional issuance This fireside chat with a sovereign issuer will explore debt issuance in the MENA region, with a focus on effective funding strategies for regional debt management offices. The discussion will examine key trends in sovereign and sub-sovereign issuance, approaches to investor engagement, market access considerations, and best practices in funding strategy design across the region.

|

|

| 14:35 | Break | |

| 15:05 | Panel discussion: Islamic finance as a driver of capital market growth This discussion will explore regional sukuk trends and the role of Islamic finance in deepening and developing capital markets. The discussion will focus on mainstreaming sukuk through greater standardisation across the bond lifecycle, including progress on Sharia-compliant repo markets and documentation alignment. Panelists will also examine how Islamic products and digital channels can mobilise domestic capital, broaden institutional and retail investor participation, and enhance the global appeal of sukuk beyond MENAT and the traditional Islamic investor base. Moderator: Mohammed Sharaf, Treasurer, Islamic Development Bank & ICMA MENAT Regional Chair

|

|

| 15:45 | Panel discussion: Sustainable finance and transition markets in MENAT Speakers will examine the growth of sustainable finance markets in MENAT, highlighting key issuance trends, the role of transition finance in emerging and resource-intensive economies, and the rise of blue bonds and other regionally relevant thematic instruments. The discussion will also explore alignment with global sustainable finance standards and strategies to expand the international investor base for MENAT sustainable instruments. Moderator: Vijay Bains, Chief Sustainability Officer, Emirates NBD Bank

|

|

| 16:25 | Electronifying the primary market: Building the foundations of liquidity Recent market trends have underscored the critical role of primary markets amid ongoing liquidity constraints, rapid growth in private credit, and expanding retail and SME access to funding. As primary issuance in the GCC continues to reach record levels, this session explores how technological evolution - enhancing transparency, efficiency, and scalability - can strengthen primary market infrastructure and lay the groundwork for deeper, more liquid secondary markets. Ebru Boysan, Market Specialist Debt Capital Market, Middle East and Africa, Bloomberg |

|

| 16:45 | Case study: Digitalisation of capital markets This session will present a practical case study highlighting how digitalisation is being implemented in MENAT capital markets. Through a real-world example, the discussion will showcase the use of digital tools and platforms to enhance issuance, distribution, transparency, or market efficiency, and will highlight key lessons learned and implications for broader market development across the region. Moderator: Razvan Dumitrescu, Sustainable Finance Director, Emirates NBD Capital

|

|

| 17:05 | Closing keynote address Zahabia Gupta, Head of Emerging Markets Credit Research, S&P Global |

|

| 17:20 | Closing remarks Bryan Pascoe, Chief Executive, ICMA |

|

| 17:25 | Networking reception | |

| 19:00 | Event close |

| Overview of the latest developments in the sustainable bond markets: an ICMA and BofA Securities training workshop (by invitation only) Organised by: ICMA and BofA Securities Time: 08:30 - 16:30 SGT, Tuesday, June 27 Venue: The Westin Singapore ICMA and BofA Securities will hold a one-day training workshop aimed at regulators, issuers, investors and other market participants from the APAC region on June 27 at the Westin Singapore. The workshop will cover a comprehensive range of topics including: an overview of the Principles, financing themes such as climate transition, blue and biodiversity, overview of the EU/ASEAN taxonomies, an update on external reviews, disclosures and reporting as well as a case study on sustainability-linked bond issuance. Presenters will include representatives from ICMA, IFC, Ministry of Economy, Trade and Industry of Japan, BofA Securities, RAM Sustainability and Dentons Hong Kong. |

| Roundtable on Singapore GFIT Taxonomy (invitation only) Organised by ICMA Time: 10:00-11:30 SGT, Tuesday, 27 June 2023 Venue: Singapore |

| Roundtable on global and Asian transition finance (invitation only) Organised by ICMA Time: 15:30-17:00 SGT, Tuesday, 27 June 2023 Venue: Singapore |