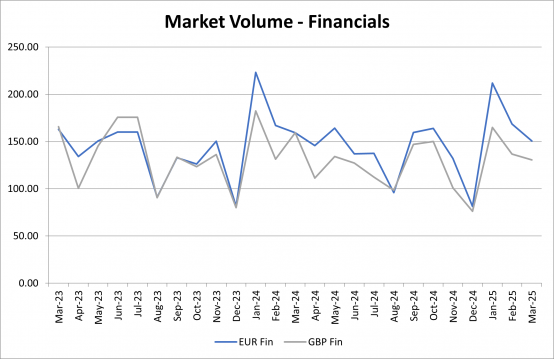

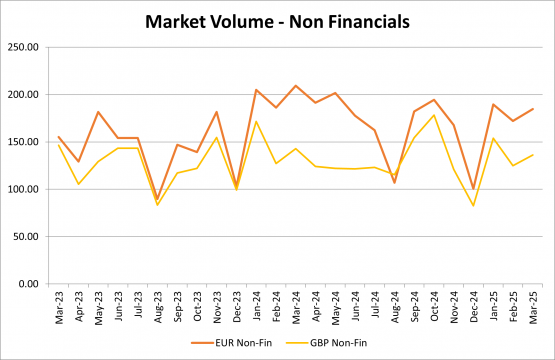

Market Volume: Observed trades in EUR and GBP investment grade corporate bonds

ICE Data Services incorporates a combination of publicly available data sets from trade repositories as well as proprietary and non-public sources of market colour and transactional data across global markets, along with evaluated pricing information and reference data to support statistical calibrations.

The market volume evolution represents the changes in the monthly aggregate volumes of all observed trades in securities in the relevant group, based to 100 as at September 2015. EUR Financials include approximately 4000 securities, GBP Financials 1500, EUR Non-Financials 3000, and GBP Non-Financials 1000.

ICMA intends to publish and monitor the market volume of IG Financials and Non-Financials on a monthly basis upon necessary permission of ICE Data Services.

Source: ICE Data Services

Top-traded corporate bonds in March 2025 (by volume)

ICE Data Services sources publicly available data sets from trade repositories and procures information from non-public sources of market colour and transactional data across global markets. Additionally, market colour, bid lists, dealer runs, and other transactional data is received from their global network of clients on the buyside and sell-side.

While the rankings are based on traded volumes, the right-hand column (of below tables) indicates the relative volume of each bond expressed as a percentage of the most actively traded bond’s volume (100%).

EUR Financials

| Rank | Issuer | Coupon and Maturity | ISIN | Relative volume |

| 1 | KREDITANST FUR WIE | 2.875% GTD SNR 31/03/32 EUR | XS2816013937 | 100% |

| 2 | KREDITANST FUR WIE | 2.75% GTD SNR 17/01/35 EUR | DE000A383TE2 | 86% |

| 3 | KREDITANST FUR WIE | 2.625% GTD SNR 10/01/34 EUR | DE000A352ED1 | 73% |

| 4 | KREDITANST FUR WIE | 2.375% GTD SNR 05/08/27 EUR | DE000A351Y94 | 52% |

| 5 | KREDITANST FUR WIE | 2.375% GTD SNR 11/04/28 EUR | DE000A383TD4 | 51% |

| 6 | JPM | 3.588%-FRN SNR 23/01/36 EUR | XS2986317506 | 43% |

| 7 | BPCE | 3.875%-FRN 26/02/2036 EUR | FR001400XLI1 | 39% |

| 8 | DZ HYP AG | 2.75% PFBRF 27/02/2032 EUR | DE000A3825P2 | 38% |

| 9 | BK OF AMERICA CORP | 3.485%-FRN SNR 10/03/34 EUR | XS3019219859 | 37% |

| 10 | KREDITANST FUR WIE | 0.125% GTD SNR 09/01/32 EUR | DE000A3E5XN1 | 36% |

Source: ICE Data Services

GBP Financials

| Rank | Issuer | Coupon and Maturity | ISIN | Relative volume |

| 1 | KOMMUNALBANKEN AS | 4.375% EMTN 23/10/2028 GBP | XS3010338856 | 100% |

| 2 | KREDITANST FUR WIE | 4.25% GTD SNR 15/02/30 GBP | XS3006160033 | 96% |

| 3 | KREDITANST FUR WIE | 4.375% GTD SNR 31/01/28 GBP | XS2975081303 | 78% |

| 4 | KREDITANST FUR WIE | 4.875% GTD SNR 10/10/28 GBP | XS2679764493 | 58% |

| 5 | LANDWIRT RENTENBK | 4.375% GTD SNR 10/01/30 GBP | XS2972044163 | 40% |

| 6 | KREDITANST FUR WIE | 0.125% GTD SNR 30/12/26 GBP | XS2281478268 | 28% |

| 7 | UBS AG LONDON | 7.75% SNR EMTN 10/03/26 GBP | XS2575155671 | 25% |

| 8 | BARCLAYS PLC | 5.851%-FRN SNR 21/03/35 GBP | XS2790094523 | 23% |

| 9 | DEUTSCHE BANK AG | 4%-FRN SNR NPF 24/06/26 GBP | XS2480050090 | 22% |

| 10 | KREDITANST FUR WIE | 3.75% GTD SNR 09/01/29 GBP | XS2744169637 | 20% |

Source: ICE Data Services

EUR Non-Financials

| Rank | Issuer | Coupon and Maturity | ISIN | Relative volume |

| 1 | NORDRH-WESTFALEN | 2.7% SNR 05/09/2034 EUR1000 | DE000NRW0PN7 | 100% |

| 2 | CHROME BIDCO S A S | 3.5% GTD 31/05/2028 EUR | XS2343000241 | 33% |

| 3 | FRESENIUS SE&KGAA | 0% BDS 11/03/28 EUR100000 | DE000A4DFSR9 | 32% |

| 4 | EUTELSAT S.A. | 9.75% SNR 13/04/2029 EUR | XS2796660384 | 27% |

| 5 | REGION WALLONNE | 3.9% SNR EMTN 22/06/54 EUR | BE0390135011 | 26% |

| 6 | BARRY CALLEBAUT NV | 4.25% GTD SNR 19/08/31 EUR | BE6360449621 | 22% |

| 7 | JOHNSON & JOHNSON | 3.7% SNR 26/02/55 EUR100000 | XS3005215689 | 22% |

| 8 | CHEPLAPHARM ARZNE | 7.5% GTD 15/05/2030 EUR | XS2618867159 | 20% |

| 9 | FORVIA | 5.5% SNR 15/06/31 EUR100000 | XS2774392638 | 20% |

| 10 | TOTALENERGIES CAPI | 3.852% GTD SNR 03/03/45 EUR | XS3015113882 | 20% |

Source: ICE Data Services

GBP Non-Financials

| Rank | Issuer | Coupon and Maturity | ISIN | Relative volume |

| 1 | JET2 PLC | 1.625% CNV GTD 10/06/26 GBP | XS2351465179 | 100% |

| 2 | CIDRON AIDA FINCO | 6.25% GTD 01/04/2028 GBP | XS2325700164 | 98% |

| 3 | HEATHROW FINANCE | 4.125% SNR SEC 01/09/29 GBP | XS2081020872 | 82% |

| 4 | MOTABILITY OPERATI | 5.625% GTD SNR 24/01/54 GBP | XS2742661122 | 76% |

| 5 | MOTABILITY OPERATI | 5.75% GTD SNR 11/09/48 GBP | XS2678308516 | 75% |

| 6 | VODAFONE GROUP | 3% SNR EMTN 12/08/2056 GBP | XS1472483772 | 75% |

| 7 | MOTABILITY OPERATI | 6.25% GTD SNR 22/01/45 GBP | XS2978917404 | 73% |

| 8 | 888 ACQUISITIONS L | 10.75% GTD 15/05/2030 GBP | XS2817891984 | 69% |

| 9 | MOTABILITY OPERATI | 2.375% GTD SNR 03/07/39 GBP | XS2021481663 | 67% |

| 10 | MCDONALD'S CORP | 4.125% SNR MTN 11/06/54 GBP | XS1075996907 | 67% |

Source: ICE Data Services

Download

Historical data of the most actively traded corporate bonds on a monthly basis can be found below:

February 2025

January 2025

December 2024

November 2024

October 2024

September 2024

August 2024

June 2024

April 2024

March 2024

February 2024

January 2024

December 2023

November 2023

October 2023

September 2023

August 2023

June 2023

May 2023

April 2023

March 2023

February 2023

January 2023

December 2022

November 2022

October 2022

September 2022

August 2022

See our archive for data (from January 2018).

This document is provided for information purposes only and should not be relied upon as legal, financial, or other professional advice. While the information contained herein is taken from sources believed to be reliable, ICMA does not represent or warrant that it is accurate or complete and neither ICMA nor its employees shall have any liability arising from or relating to the use of this publication or its contents.

SW (FINANCE) I PLC